Key Findings

By Health Loop Team

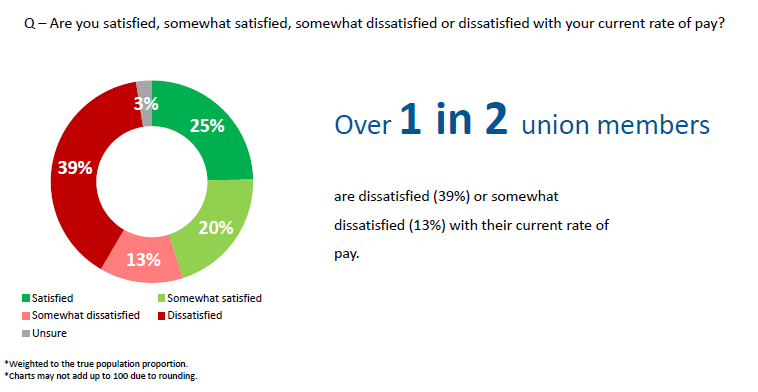

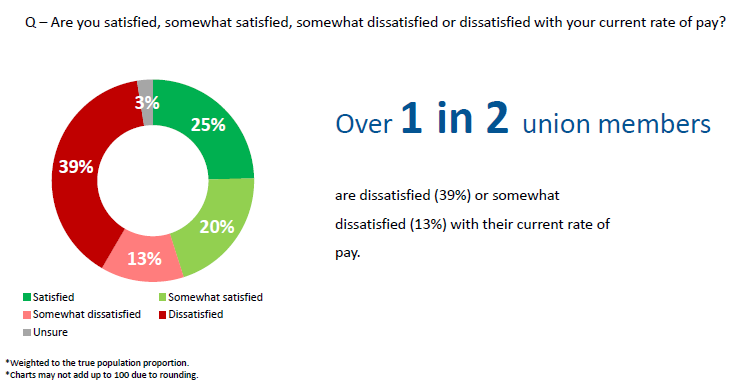

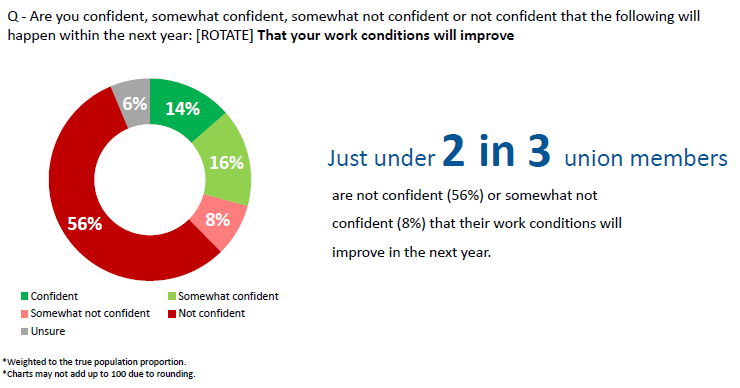

Unsatisfactory Workplace

Conditions

ineffective UI/UX design reducing product appeal, limited customer discovery failing to address market demands, and inadequate technology roadmapping slowing progress and innovation.

- Product Design (UI/UX Design)

- Customer Discovery

- What counts is the right approach and commitment