Programmers.io is an India based software development company that offers affordable IT services on multiple platforms like Java, IBM, Dot Net, etc. It’s also an IBM-certified software outsourcing company and a Microsoft Gold partner. Here, we’ll explore the benefits of outsourcing your accounting services to help you decide whether it’s a good option for your organization, or not. Managing financial accounts, from bookkeeping to financial reporting, to managing invoices remains a pivotal aspect of any business strategy. Yet, this task can be time-consuming and challenging, especially for SMBs lacking dedicated financial professionals.

Financial planning and analysis

F&A outsourcing now plays a critical role in enhancing operational flexibility and financial performance, influenced by rapid technological advancements, regulatory shifts, and economic fluctuations. This blog explores key trends that are expected to shape financial operations in 2024, offering insights to leverage these developments for growth and resilience in challenging times. One of the main advantages of outsourcing accounting services is that it frees up your time and energy to focus on your core business activities.

offer letter templates for small businesses

Bring an experienced accounting team on board with the best practices in bookkeeping and regular financial reports. The Pineapple Corporation is a US-based business process outsourcing company that offers automation for all business interactions and other manual work. For this, the company offers an AI digital platform to manage communications with organizations, stakeholders, and customers. Based out of the United States and Philippines, SupportNinja is a cutting edge outsourcing company that lends support to startups and businesses around the world. It offers customer service, content moderation, and back-office support to companies.

Don’t outsource invoicing

No matter the size of your company, you want the best set of hands to handle your financial records. Accounting services are available to you that provide this level of assistance. FreshBooks offers support from highly knowledgeable help centre staff, along with dedicated account management, advisory services, and connections to expert accountants near you. Freshbooks has advanced tools, including accounting software that gives you 24/7 access to financial data. If you’re big enough that you’re considering a controller but not big enough to need one full-time, an outsourced controller might be the right move. Over the past decade, many companies have decided to outsource these functions to professionals because they can have a tremendous long-term impact on their business.

CFO & enterprise value

However, this might not be cost-effective and, as your company grows, it might not be scalable either. You may also be tempted to manage your own books to keep costs down but, without https://www.accountingcoaching.online/amortization-accountingtools-3/ any accounting experience, it’s easy to make a potentially costly mistake. Furthermore, outsourcing to an accounting firm allows you to work with a team of financial experts.

Advantages of Outsourced Bookkeeping

- Having a dedicated four-person accounting team outside of your business reduces your risk of fraud, and increases accountability, by incorporating proper internal controls.

- As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited.

- You can also benefit from regular feedback and reviews from your outsourcing provider that can help you identify and correct any errors or issues.

- Outsourcing invoicing to an accounting firm can be more expensive than necessary; it may not add much value to your business either.

- For some companies, this time investment might outweigh the benefits and become a significant consideration in terms of both time and expenses.

You may rest assured that your accounting is in the hands of a reliable and knowledgeable business if you choose an outsourcing provider wisely. When paying employees’ salaries on an hourly or monthly wage, you must consider recruiting, onboarding, employee benefits, and insurance. These issues can quickly drive up operating costs, making an in-house accounting team more trouble than it’s worth. Cost-effectiveOutsourced bookkeeping is most appealing since it saves organisations money. It does so in various ways, including minimising the cost of hiring an in-house team and saving you time to focus on the core business.

By outsourcing repetitive and time-consuming work, your employees can dedicate their time and energy to higher-order tasks like strategizing and planning. Outsourcing is the process where a business delegates certain non-core business process activities to a third party. Introduction The increasing integration of technology in financial services highlights the growing i… Essentially, they function as an off-site accounting department, supporting the company in analyzing and enhancing its accounting operations for efficiency. Outsource Accelerator is the leading Business Process Outsourcing (BPO) marketplace globally. We are the trusted, independent resource for businesses of all sizes to explore, initiate, and embed outsourcing into their operations.

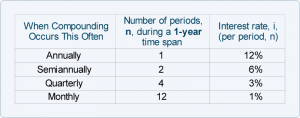

AI systems categorize transactions based on historical data, increasing speed and accuracy. They also use predictive analytics to forecast financial trends, aiding strategic planning. Additionally, defining your objectives, like improving cash flow or gaining better financial visibility, is crucial.

Payroll process consulting includes reviewing payroll policies and procedures, implementing automated payroll systems, and ensuring compliance with legal and regulatory requirements. Outsourcing this service can help businesses optimize their payroll processes, ensure compliance with regulatory requirements, and reduce the risk of errors and fraud. In this guide, we’ll cover the key accounting services businesses can outsource and explore the pros and cons of accounting outsourcing and the important tips to keep in mind. Bookkeeper.com is an all-around solid pick for small to midsize businesses that might want additional payroll and tax help down the road. But Merritt Bookkeeping is a cheaper option, inDinero has even more add-ons, Bench’s bookkeepers work seamlessly with your own CPA, and Bookkeeper360 integrates with some of our favorite HR and payroll providers.

When your offshore team cares about the outcomes of their work, they’ll work harder and commit to continuous improvement. However, the outsourcing industry has changed significantly in recent years. Many of the concerns that might be swirling in your mind have been addressed.

Below, we list some benefits and drawbacks of accounting outsourcing and provide insights into whether it could be the right choice for your business. Having a dedicated four-person accounting team outside of your business reduces your risk of fraud, and increases accountability, by incorporating proper internal controls. Cash flow forecasting allows a company to do strategic planning with what’s a good profit margin for a new business confidence despite annual fluctuations in cash flow. Learn how to overcome the accounting staffing crisis from the CEO of the company leading the outsourced accounting movement. Stay updated with the latest important US tax dates with our comprehensive guide! Firm Forward is a guide for accounting firm leaders looking to add a global team to their business or have already done so.

Not only can they help you be legally compliant, but outsourced accounting services and bookkeeping services can also help you grow your business, achieve your goals, and set you up for long-term success. Many finance and accounting firms https://www.simple-accounting.org/ used to offer an all-or-nothing approach to accounting, but things have changed. With increased customer-centricity in business and understanding that every business has unique needs, we have seen a major shift towards customization.

Another major risk is receiving low-quality accounting and bookkeeping services, an issue that can be mitigated by using a local or well-established accounting and finance team. Although it may sound counterintuitive, one of the main benefits of outsourcing accounting is that it can actually save your business money. Virtual, outsourced, and online are often used interchangeably when referring to bookkeeping and accounting. However, a virtual bookkeeper or virtual accountant can sometimes refer to accountants or CPAs who work out of their homes and contract out their services individually.

But now organizations also expect CFOs to identify and ignite strategic change, so the business grows value profitably and sustainably. Access to tax and wealth advisors can assist in building an efficient financial roadmap for your business. They can help you with individual tax planning, business continuity, disaster recovery and risk management, risk mitigation, and other aspects of financial planning.